Petrochemicals: Nov 11-15: Butadiene falls sharply, cargoes from outside region arriving

Aromatics

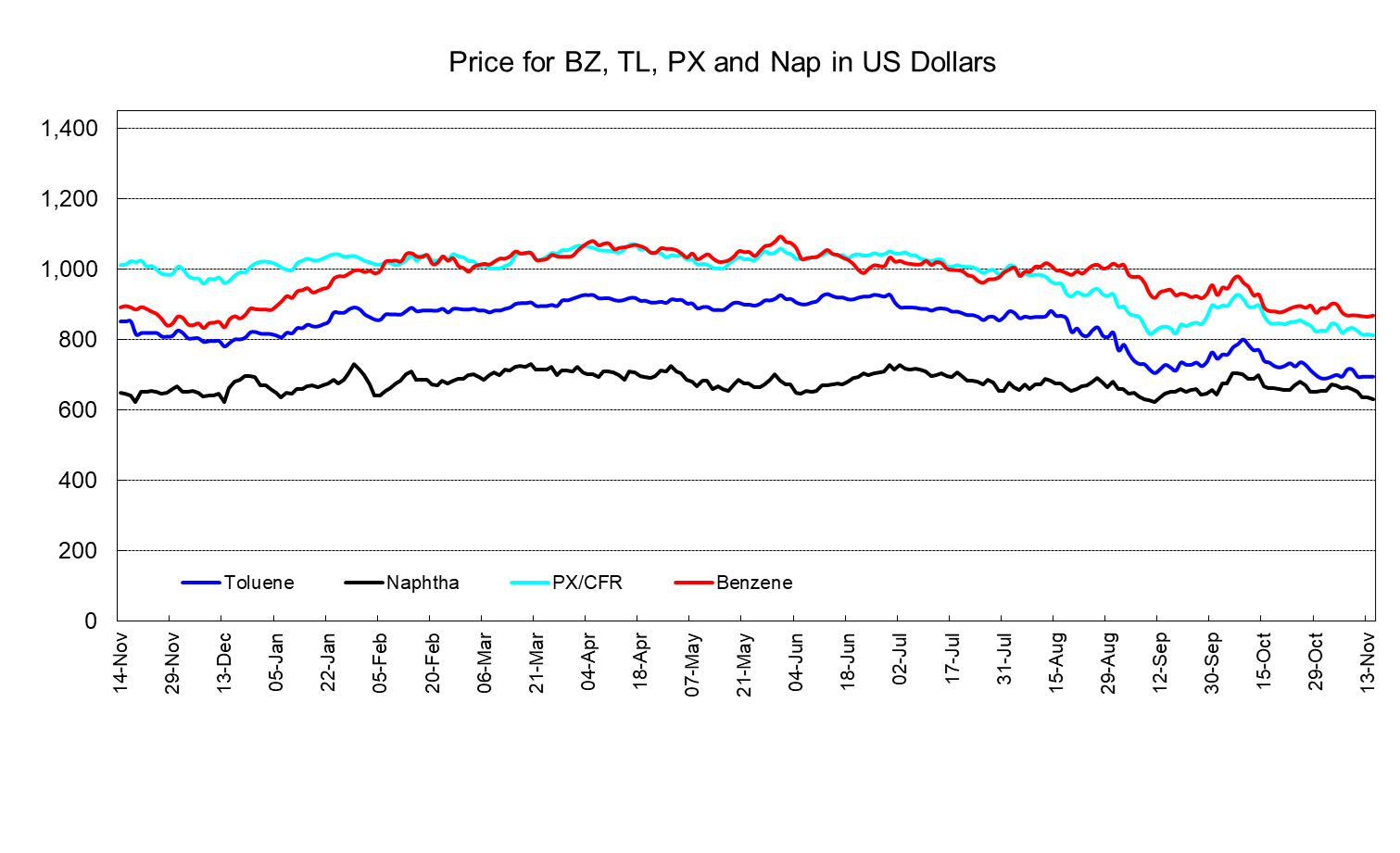

Benzene prices on an FOB Korea basis and paraxylene (PX) prices on a CFR Northeast Asia basis were at low levels. Along with the result of the presidential election in the US, new duties might be imposed on products exported from China to the US. Producers of end-products were wary of this. Under this situation, demand for petrochemical products was unlikely to rise.

Olefins

In the CFR Northeast Asia ethylene market, discussions were muted. As for facilities, on-spec products were confirmed at Tianjin Nangang's new ethylene and derivative facilities in China. As several other new ethylene facilities were also scheduled to start up in China going forward, supply for ethylene might be more plentiful in the Northeast Asia market.

In the Asia propylene market, activity was muted.

In the CFR Northeast Asia market, buying interest from end-users was scarce as supply for domestic cargoes in China was ample. On the other hand, sellers did not have many spot cargoes and they were not in a rush for trade.

On an FOB basis, Taiwan's Formosa Petrochemical conducted a sell tender for December loading.

In the Southeast Asia market, JG Summit in the Philippines would reportedly shut down its naphtha cracker from second-half December due to worsening profitability.

Butadiene prices in Asia softened sharply. Since many cargoes from outside Asia were scheduled to be delivered in November onwards, supply was perceived to be ample. On the other hand, demand for imported cargoes was low as China domestic butadiene prices and synthetic rubber prices were falling.

In Southeast Asia, some petrochemical makers conducted sell tenders for December loading.

To view sample report, click the button below.