Petrochemicals: Oct 28-Nov 1: Butadiene still bearish on ample supply

Aromatics

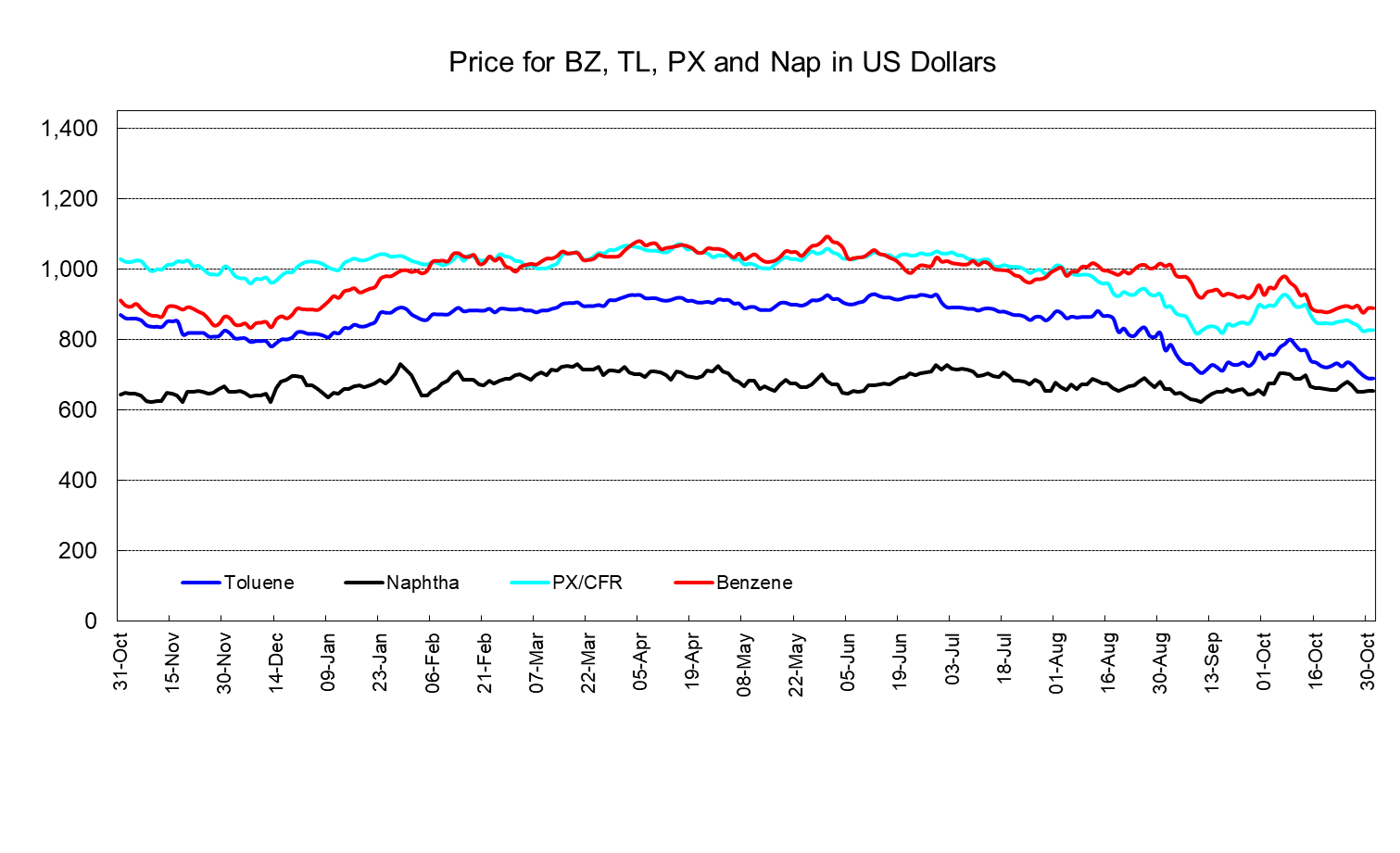

Benzene prices on an FOB Korea basis and paraxylene (PX) prices on a CFR Northeast Asia basis softened in the first half of the week due to a sharp fall in crude prices. After that, crude prices bottomed out and prices for benzene and PX also recovered slightly. Regarding polyester fibers, downstream products of PX, demand for use in winter clothing was peaking out. Therefore, demand was expected to recede going forward.

Olefins

In the Northeast Asia ethylene market, discussions for December cargoes were still not in full swing and the market was in a wait-and-see mood. But as benchmark feedstock crude prices were bearish, ethylene prices might soften going forward. In the Southeast Asia market, a Malaysian petrochemical maker conducted a sell tender since its derivative facility was experiencing troubles.

The Asia propylene market was bearish.

In the CFR Northeast Asia market, China domestic prices were softening and Chinese end-users were unwilling to buy imported cargoes at higher levels that domestic prices. As a result, market sentiments were weak.

In South Korea, LG Chem conducted a sell tender for December loading.

In the Southeast Asia market, a Malaysian petrochemical maker conducted a sell tender for November loading.

The Asia butadiene market was bearish due to perceptions of slack supply/demand.

In the CFR Northeast Asia market, several cargoes from outside the region were scheduled to be delivered in November onwards and supply was seen to be ample. On the other hand, end-users perceived that prices might decrease going forward and buying interest for spot cargoes was scarce. Under this situation, market sentiments were weak.