Petrochemicals: Sep 9-13: Aromatics fall sharply on softening crude prices

Aromatics

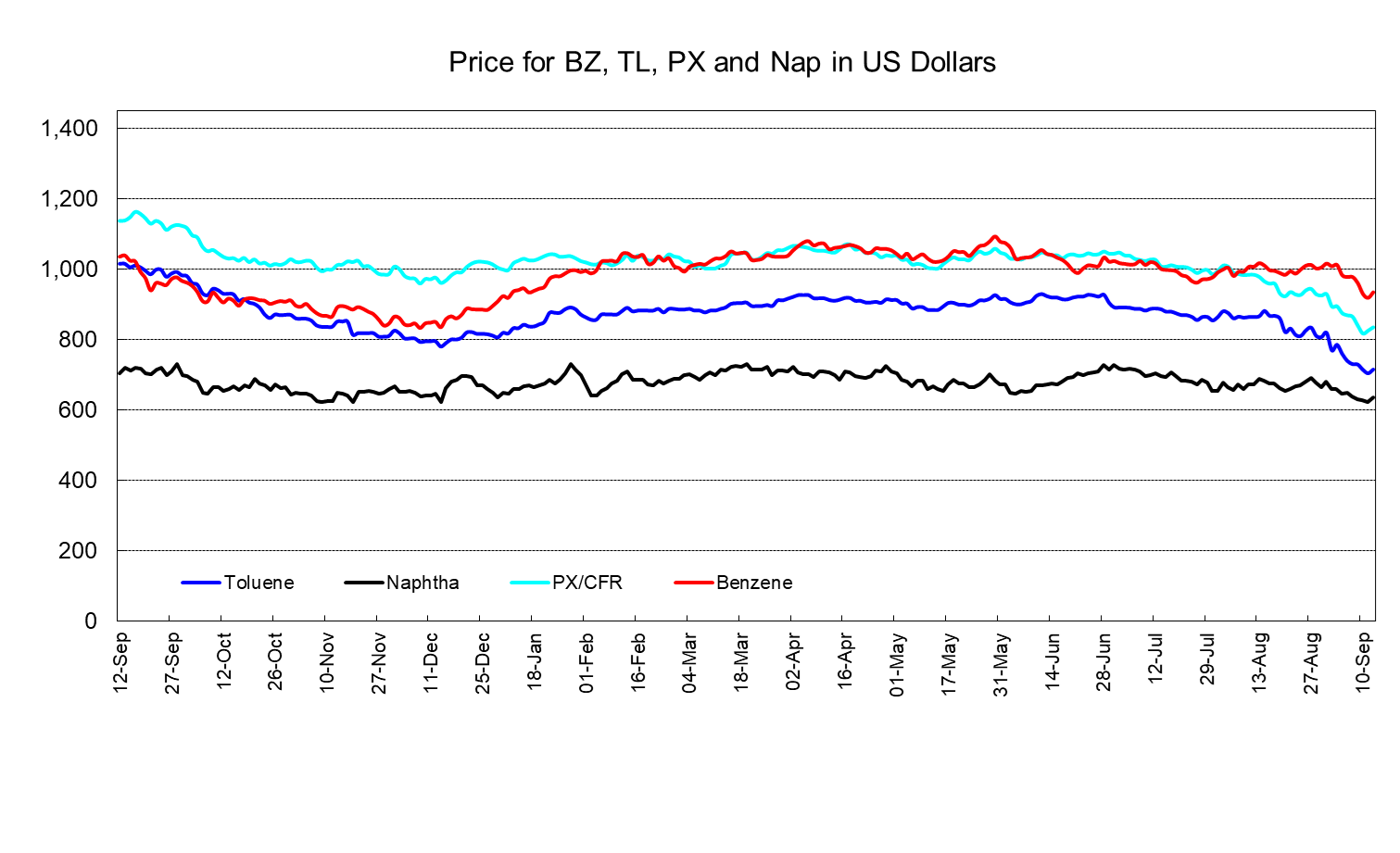

Benzene prices on an FOB Korea basis and paraxylene (PX) prices on a CFR Northeast Asia basis fell sharply until the middle of the week along with a sharp decrease in crude prices. For PX, supply was high while demand for downstream polyester products was low and supply/demand was slack. The price spread between PX and naphtha was shrinking recently.

Olefins

In the CFR Northeast Asia ethylene market, end-users were showing a wait-and-see stance as prices were expected to decrease going forward. Due to a recent fall in crude prices, benchmark feedstock naphtha prices also softened and the spread between naphtha prices and ethylene prices widened. This was a reason for the perceptions that ethylene prices might decrease. Further, the number of ethylene facilities that were shut down due to maintenance or troubles were less than when discussions for September cargoes had taken place. Therefore, supply/demand was said to be slackening.

The Asia propylene market was bearish.

In the Northeast Asia market, buying interest from end-users was receding amid softening crude prices. On the other hand, supply for Southeast Asian cargoes was ample. As a result, supply/demand was perceived to be slack.

On an FOB Korea basis, a petrochemical maker conducted a sell tender for October loading.

In the Southeast Asia market, a Malaysian petrochemical maker sold propylene on a spot basis since its derivative polypropylene facility was shut down.

The Asia butadiene market strengthened.

In the CFR Northeast Asia market, buying interest from Chinese end-users was strong as China domestic prices were firm recently. Under this situation, possible deal levels increased.

In the Southeast Asia market, two petrochemical makers conducted sell tenders for October loading.

To view sample report, click on the button below.